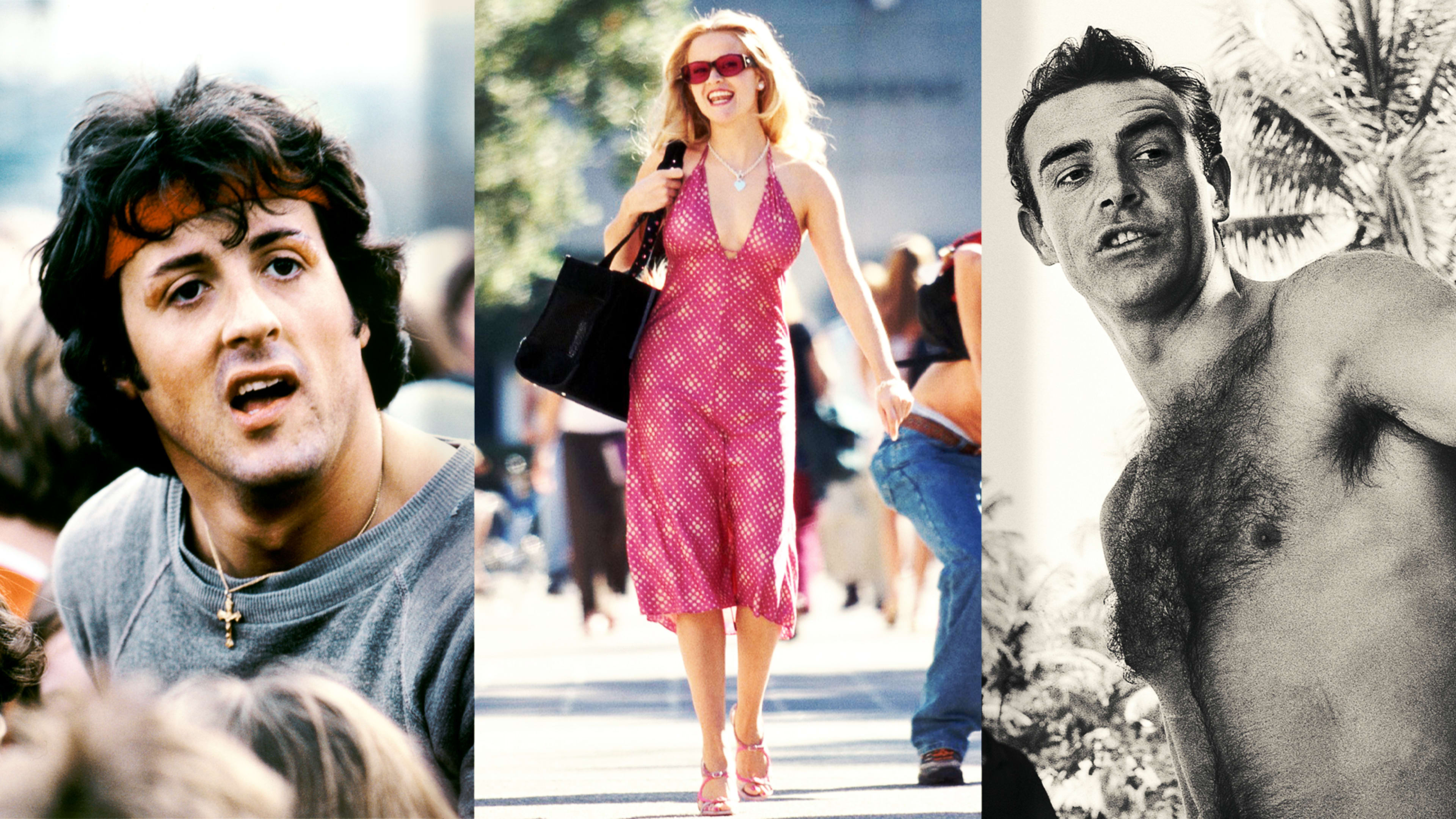

In Tuesday’s announcement of Amazon’s $8.5 billion acquisition of MGM—the historic film studio behind the Rocky, Legally Blonde, and James Bond franchises—Mike Hopkins, senior vice president of Prime Video and Amazon Studios, naturally dropped two major Hollywood buzzwords.

“The real financial value behind this deal,” Hopkins said, “is the treasure trove of” —ding-ding-ding— “IP in the deep catalog that we plan to reimagine and develop together with MGM’s talented team. It’s very exciting and provides so many opportunities for high-quality” —ding-ding-ding— “storytelling.”

Yes, in the latest proposed media merger, intellectual property will be married with innovative storytelling to create a company like no other. This has never been done before . . . if you don’t count Disney, Comcast, Sony, ViacomCBS, or the 10-day-old prospective merger of Warner-Discovery. Indeed, just as Marvel and Star Wars spin-off TV shows now populate Disney Plus, prepare yourself for a Rocky-themed reality-TV show (with real boxers!) and as many Bond prequels as Barbara Broccoli and Michael G. Wilson (the highly protective producers of the franchise) will allow for, to roll out on Amazon Prime Video.

What is more worrisome, though, is the even greater monopolistic foothold that this deal gives one of the world’s richest and most powerful companies, one whose market cap is not in the billions but trillions. Now, beyond just selling its own products, like baby oils, in its own marketplace and thus edging out smaller, independent businesses, Amazon will be doing the same thing with movies and TV shows at a scale of 10 times what it’s currently been doing in entertainment. The MGM library consists of more than 4,000 films and 17,000 TV episodes.

It’s an issue that politicians on all sides of the spectrum have been railing about for years now when it comes to Big Tech, and those cries will undoubtedly grow louder in the coming weeks, potentially even affecting this deal, which rests upon regulatory approval. (Just this week, the District of Columbia sued Amazon on antitrust grounds relating to its pricing contracts with third-party sellers.)

Back when she was a presidential hopeful in 2019, Democratic Senator Elizabeth Warren of Massachusetts drafted an antitrust bill aimed at companies like Amazon and Facebook that would not only block mergers and acquisitions but affect how those companies treat their competitors and how they price their products. More recently, another 2020 presidential aspirant, Democratic Senator Amy Klobuchar of Minnesota, published a 702-page book titled, Antitrust: Taking on Monopoly Power From the Gilded Age to the Digital Age. And Republican Senator Josh Hawley of Missouri, who published The Tyranny of Big Tech in May, introduced the “Trust-Busting for the Twenty-First Century Act” this spring, taking aim at “a small group of woke mega-corporations,” including Amazon, that “control the products Americans can buy, the information Americans can receive, and the speech Americans can engage in.” Hawley specifically seeks to ban all mergers and acquisitions by companies with a market capitalization greater than $100 billion. Amazon’s market cap as of the market close on Wednesday was $1.65 trillion.

Indeed, Senator Hawley expressed his disapproval shortly after the news broke:

This sale should not go through. @amazon is already a monopoly platform that owns e-commerce, shipping, groceries & the cloud. They shouldn’t be permitted to buy anything else. Period. https://t.co/YyOdQ6iWPQ

— Josh Hawley (@HawleyMO) May 26, 2021

Senators Warren and Klobuchar had not tweeted about the merger as of late Wednesday.

Getting away from the big-picture argument about a free market, let’s return to the more micro sense of what this deal will mean. Let’s consider what it means for entertainment to be even more firmly in the grip of a company that is ultimately more concerned about how many rolls of toilet paper it sells on Amazon each year than how many people stream Jack Ryan. In Brad Stone’s recently published book about Amazon, he recounts Amazon CEO Jeff Bezos being confused as to why it wasn’t possible to “test” TV shows the way one would test, say, a mechanical toothbrush to make sure it worked before putting it on the market.

“You are telling me that we are making $100 million decisions and we don’t have time to evaluate whether they are good decisions?” he said incredulously to former Amazon Studios head Roy Price. “There must be a way for us to see what will work and what won’t, so we don’t have to make all these decisions in a vacuum.”

He then proceeded to tick off a laundry list of all the elements that make a good show (humor, betrayal, violence, cliffhangers, etc.), saying, “This should not be that hard.”

A behemoth like Amazon buying MGM may, similarly, not be that hard. But whether it’s right for consumers and the vitality of the entertainment industry is another story.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.